But it is possible to lose a lot of money to an identity thief. Some banks and credit card companies protect their customers and don’t hold them liable for financial loss in the wake of identity theft or fraud. Who it’s best for: Folks looking for credit monitoring may find this plan useful, but we strongly recommend that you focus on plans that offer restoration and insurance.įYI: Not all identity theft will cost you. We recommend finding a service that offers both recovery and insurance, as you never know when an identity theft crisis might occur. For that price, we almost always see these additional (but still pretty basic) features. This actually surprised us, especially since the subscription fee is $19.99 per month. Unfortunately, PrivacyGuard Credit Protection does not include recovery services or insurance. It will only check your scores once per month (some brands offer daily score tracking), but note that it checks them with all three bureaus, not just one. If you go with this plan, PrivacyGuard constantly scans the three major credit bureaus and monitors your files 24/7.

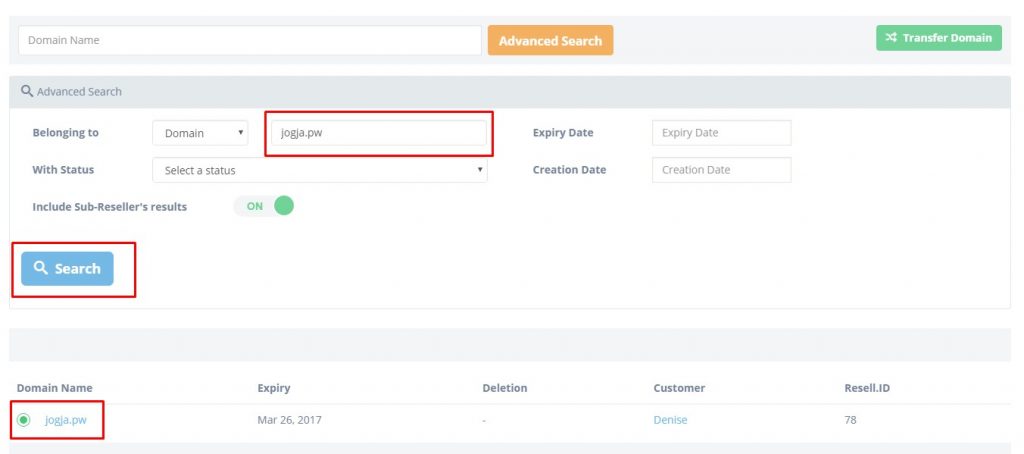

Like the name suggests, PrivacyGuard Credit Protection keeps a finger on the pulse of your credit. PrivacyGuard Dashboard Drop Down Menu PrivacyGuard Credit Protection Who it’s best for: The basic PrivacyGuard Identity Protection plan is a safe bet for people looking for an affordable safety net without credit monitoring. Remember, early detection is key! We like that PrivacyGuard’s basic plan includes financial account monitoring - as most brands only offer this with their upper-tier packages.įinally, PrivacyGuard’s cheapest plan includes recovery services and up to $1 million in identity theft insurance (but $1 million is actually the industry standard here). This allows you to investigate a potentially fraudulent transaction and jump into action to limit financial loss if necessary. So if a large transaction occurs, you’ll be the first to know. With this plan, you can also add bank and credit card accounts to be monitored. But the Dark Web is “deeper” still: You need a special browser just to access it. That includes things like password-protected sites. Anything not indexed by search engines like Google is in the Deep Web.

PrivacyGuard checks for all of these things in public records and on the internet, including the Dark Web.įYI: The Dark Web is different from the Deep Web. If you choose this option, you’ll get monitoring for your social security number, name, birthday, phone number, physical address, email address, and more. PrivacyGuard Identity Protection is the most basic plan that includes identity monitoring without credit monitoring. Easy, right? PrivacyGuard Identity Protection One PrivacyGuard plan offers non-credit “identity” monitoring. With PrivacyGuard, we can tell right away the services and level of coverage we’re getting.

So monitoring services look for your private info in places it shouldn’t be, like on the Dark Web, where crooked websites in the internet underworld let criminals buy and sell private information. Think of identifying info like email address, home address, phone number, etc.Ĭhief among the sensitive information that could be floating around online are your name and your social security number. When we refer to “identity monitoring” as something separate from credit monitoring, we’re talking about monitoring personal information.

MY PRIVACY GUARD PRO

Pro Tip: Reduce your identity theft risk by changing your passwords often, and shredding papers with personal information on it.

0 kommentar(er)

0 kommentar(er)